At lunch on Friday I told my friend that I was moving 60% of my pension holdings from stock mutual funds to money market funds. She was incredulous that I would do so after the market was already down so much. I think her statement represents the psychology of the moment. The market has already declined, so it must be too late to get out–we have to be close to the bottom. Maybe we are. But my approach to the market is to look at the price and volume patterns and to ignore my emotions and beliefs about what I might want it to do. So, when I ran one of my my TC2007 PCF ‘s (personal criteria formula) on all ETF’s, I was struck by what I saw. First of all, let me tell you that I ran this PCF several years ago and came up with a company that I knew little about. The topping pattern looked so compelling that I actually bought a put option on the stock, betting that it would decline. I did not hold the put long because I was not as convinced then of my methods. You may have heard of the stock, Enron. My PCF detected trouble in the stock’s pattern long before anything came out in the press and before the stock began a long decline to zero.

Anyway, I ran the same PCF on the list of ETF’s in TC2007 and found 91 hits out of 951. The PCF I ran detects a pattern where the long term average is just beginning to reverse down. Thus, a lot of other ETF’s that are already in established down-trends would not come up. I was struck by the ETF’s that did come up because they represented entire country markets in some cases. For example, India (BKF, INP), Latin America (ILF), Asia Pacific (GMF), China (GXC), Brazil (EWZ), Emerging Europe (GUR). Add to the list a few of the U.S. indexes that came up such as: S&P500 (IVV), Dow 30 (IYJ), Russel 1000 Growth (IWF). Russell 3000 Value (IWW). Now add to the list a whole set of industries: Financials (IYG), Metals and mining (XME), Software (IGV), Oil (IEZ), Healthcare (IYH). These are just a few of the indexes and industries whose ETF showed up in my scan.

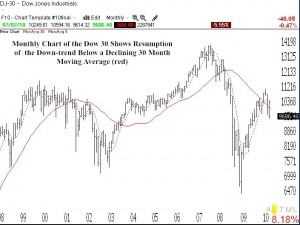

No one knows how long these down-trends will last. However, I am talking about down-trends based on weekly averages, which generally are related to major trends. For my own comfort, I would rather get out of the market and wait for these averages to reverse up again, than to gamble my critical pension money while I hope for the turn. If the market were to turn up in the next few months I would have no regrets as I would simply hop back on at a higher level. The weekly averages tend to represent trends that last for months, so I have plenty of time to ride a new up-trend. In the past, during the few times I have moved my pension funds to money market funds, I have always been scared that I was making the wrong move. But my early exits saved me from taking huge losses in the 2000-2002 and 2008 market declines. When I look at this monthly chart of the Dow 30 (click on to enlarge), I see an ending of the rebound from the 2008 decline and a possible resumption of the decline. How far the Dow 30 will fall this time is unknown, but with the other ETF’s from the rest of the world in a decline, I am staying safely on the sidelines until I see a new up-trend. See this interesting article about Robert Prechter who is predicting a massive decline–yet again!

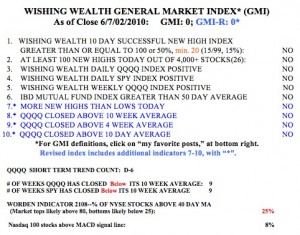

Meanwhile, the GMI and GMI-R remain at zero. The Worden T2108 Indicator is at 25%, still out of oversold territory where markets tend to bottom.  The QQQQ short term down-trend has now continued for six days. The QQQQ and SPY have closed below their critical 10 week averages for 9 weeks. And now, only 8% of the NASDAQ 100 stocks have their MACD above its signal line, a sign of short term weakness. With market leaders (GOOG, NFLX, AAPL) weakening, it bodes poorly for the entire market. When the leaders cannot hold their ground, it often portends a down market. I am mainly in cash or short and will use any short term strength to short more.

The QQQQ short term down-trend has now continued for six days. The QQQQ and SPY have closed below their critical 10 week averages for 9 weeks. And now, only 8% of the NASDAQ 100 stocks have their MACD above its signal line, a sign of short term weakness. With market leaders (GOOG, NFLX, AAPL) weakening, it bodes poorly for the entire market. When the leaders cannot hold their ground, it often portends a down market. I am mainly in cash or short and will use any short term strength to short more.

I am very concerned about the consequences to our society and to our financial well being if this market declines back to the 2008 lows or beyond. I do not generally look to the fundamentals to assess the stock market’s trends, but with federal, state and local governments apparently getting ready to sacrifice millions of workers on the altar of deficit reduction, I see little reason for an up-turn in consumer psychology and spending.

I am presenting my second Worden webinar on August 24. I plan to provide details of my submarine scan and how I find stocks to short. You can see my first webinar by going to their site (worden.com) and scrolling down to the one entitled: A word from the professor. It will be a while before you can sign up for the August free webinar. I am pleased to support Worden with these webinars because the company has been a strong supporter of my university classes in technical analysis. I compute virtually all of my market statistics using their incredible charting and analysis software.

You may contact me at: silentknight@wishingwealthblog.com

Hi Dr Wish,

I had follow-up question; what is your exit strategy on trades in your trading IRA account. Do you have targets where you exit, or do you trail stops. Also, what is the stop loss on such trades, would it be same for all; i.e, GMI turning green or you manage the stops of individual positions by certain stop loss strategy. I am asking because it seems like you like to ride the trends, which could mean wider stop loss.

Also on a related note regarding market timing and start of trend. I am wondering if you went long at the start of uptrend back on June 17 or June 18. Did you take losses on those positions, when trend reversed. Thanks in advance and appreciate your feedback.

i love your blog. are there any others that you or other readers would recommend with a similar strategy?

I think involvement in politics subtracts from your blog.

It invites distracting debate.

One issue I do agree, if the market stays stuck down after this decline, it may not recover for years.