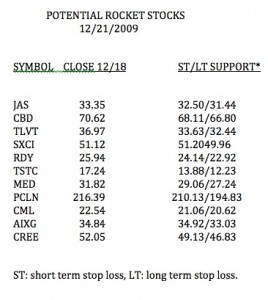

I used TC2007 to scan the market for stocks that meet my most stringent fundamental and technical criteria for rockets. These stocks have great fundamentals and technicals, have already doubled their price a year ago and are near 5 year or all-time highs. I have listed in this table the 11 stocks out of 4,000 in my stock universe that met these criteria.  All of these stocks had last quarterly earnings up at least 100%. Coincidentally, all but 4 of the 11 are in my records as having appeared on the IBD100 and/or IBD New America lists during the past year. I have also noted in this table where I might place long term or short term stop losses on each long position. The most conservative stop loss is the short term support level. With a growth stock I rarely retain a long position if the stock closes below its short term support level. However, if I bought near long term support I might use the LT support level as my exit strategy. I will return to these 11 stocks in a future post to show you how they behaved. These stocks have already proven themselves as being in strong up-trends, but one never knows when an up-trend will end. That is why I immediately enter a sell stop or buy a put option for insurance, after buying one of these high momentum stocks. I currently own 3 of these stocks.

All of these stocks had last quarterly earnings up at least 100%. Coincidentally, all but 4 of the 11 are in my records as having appeared on the IBD100 and/or IBD New America lists during the past year. I have also noted in this table where I might place long term or short term stop losses on each long position. The most conservative stop loss is the short term support level. With a growth stock I rarely retain a long position if the stock closes below its short term support level. However, if I bought near long term support I might use the LT support level as my exit strategy. I will return to these 11 stocks in a future post to show you how they behaved. These stocks have already proven themselves as being in strong up-trends, but one never knows when an up-trend will end. That is why I immediately enter a sell stop or buy a put option for insurance, after buying one of these high momentum stocks. I currently own 3 of these stocks.

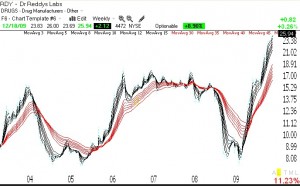

Below is a Guppy Multiple Moving Averages (GMMA) weekly chart (click on chart to enlarge) of one of these rocket stocks, RDY. Note how all of the shorter term averages (black lines) are well above the rising long term averages (red lines). This is the type of technical strength I seek in a potential rocket stock.

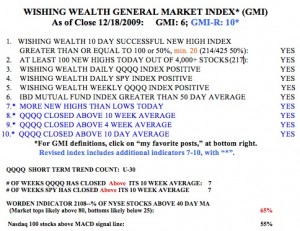

Meanwhile, the GMI and GMI-R remain at their maximum levels.

Friday was the 30th day of the current QQQQ short term up-trend.  The Worden T2108 Indicator is in neutral territory, at 65%, and 55% of the Nasdaq100 stocks had a MACD above its signal line. In addition, 37% of the Nasdaq100 stocks had their fast stochastic line above their slow stochastic line, a new measure of the short term up-trend that I am trying out….

The Worden T2108 Indicator is in neutral territory, at 65%, and 55% of the Nasdaq100 stocks had a MACD above its signal line. In addition, 37% of the Nasdaq100 stocks had their fast stochastic line above their slow stochastic line, a new measure of the short term up-trend that I am trying out….

I listened a little to CNBC last week and realized how anxious I became about the market and how much my judgment was impaired. Nicolas Darvas had it right when he described how listening to the media and the current market gossip destroyed his ability to trade profitably. Tune everyone out and follow your own judgment and your own rules.

Very nice post with the screen results et all. I agree that tuning in on CNBC is more than just a waste of time.

I have been thinking similar thoughts with this market and the various news, podcasts & blogs I read. Too often, I am listening to find someone else to reinforce my own market decisions (good or bad). This is a big challenge to consider simplifying & minimizing what influences my trading decisions and is not entirely easy but something I want to do.

It’s really easy–just use the mute button!