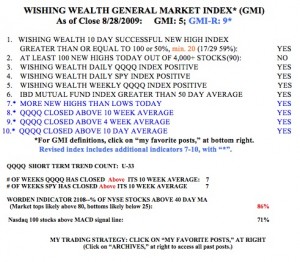

One must not argue with the market. It peaked long before the bad news came out and it has bottomed before a lot of good news has come out. As a Maryland state employee, I am learning that we will lose 8-10 days of pay over the next 12 months. I know MD is not the only state facing huge budget deficits, so I am incredulous how the market can act like things are betting better. So many employees are looking at slimmer paychecks. Given that a few months ago we feared that the economy was going to collapse, maybe the fact that it hasn’t has precipitated a relief rally. The patient remains in the ICU, but apparently will survive. As my GMI table below shows,

the GMI remains at a strong 5 out of 6. With readings consistently at 4 or above, I must remain long in this market. I tune out the media pundits and try to concentrate on my indicators.  If 100 stocks in my universe of 4,000 hit a new high on Monday (90 did on Friday) the GMI will register 6. Note that 71% of the Nasdaq 100 stocks closed with their MACD above their signal lines, a show of strength. The T2108 remains at a high level (86%) but can remain there for weeks. The QQQQ and SPY have closed above their important 10 week averages for seven straight weeks. It is in periods like this that I can make money trading on the long side. I am mainly in QLD and a small number of growth stocks.

If 100 stocks in my universe of 4,000 hit a new high on Monday (90 did on Friday) the GMI will register 6. Note that 71% of the Nasdaq 100 stocks closed with their MACD above their signal lines, a show of strength. The T2108 remains at a high level (86%) but can remain there for weeks. The QQQQ and SPY have closed above their important 10 week averages for seven straight weeks. It is in periods like this that I can make money trading on the long side. I am mainly in QLD and a small number of growth stocks.

State employees being furloughed is probably a greater indication of horrible budgetary planning by our elected state assemblymen than broad weakness in the economy. Although the former may have an effect on the latter as politicians look to hit up private industry to pay for their suddenly underfunded pet projects.