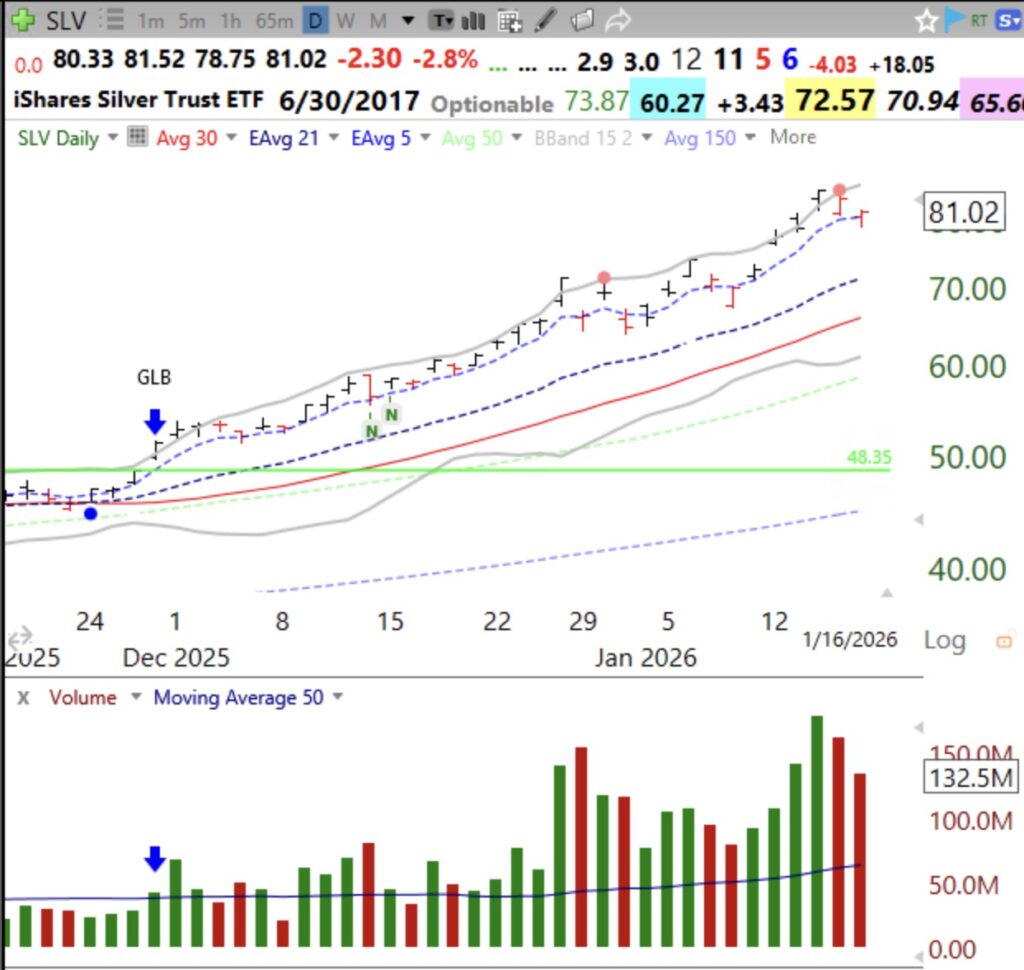

Note that SLV has closed above its 5EMA (blue dotted line) every day but 3 sinces its GLB to ATHs. Strongly advancing stocks tend to hold their daily 5EMA. If I owned SLV I would place a stop loss just below the low of the day it closes below its 5EMA. I might also buy a bounce up off of the 5EMA, as occurred last Friday.

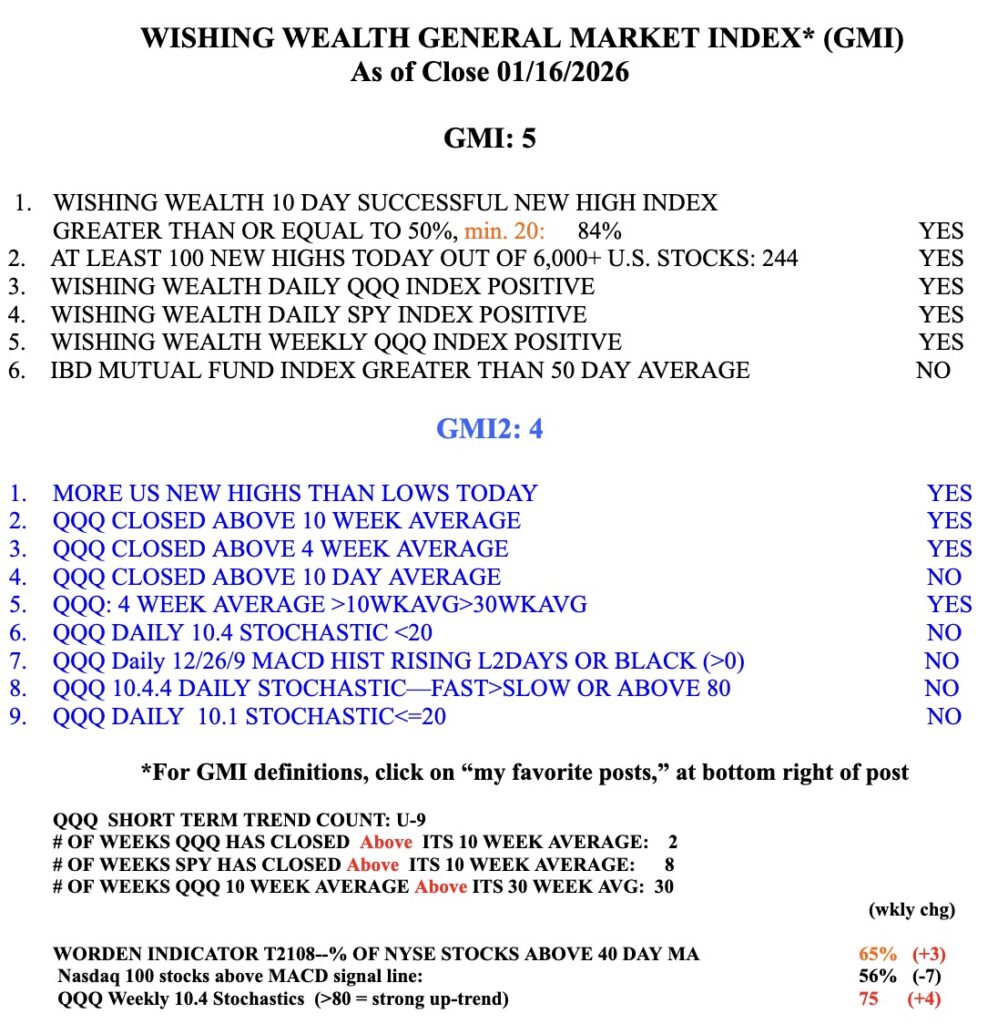

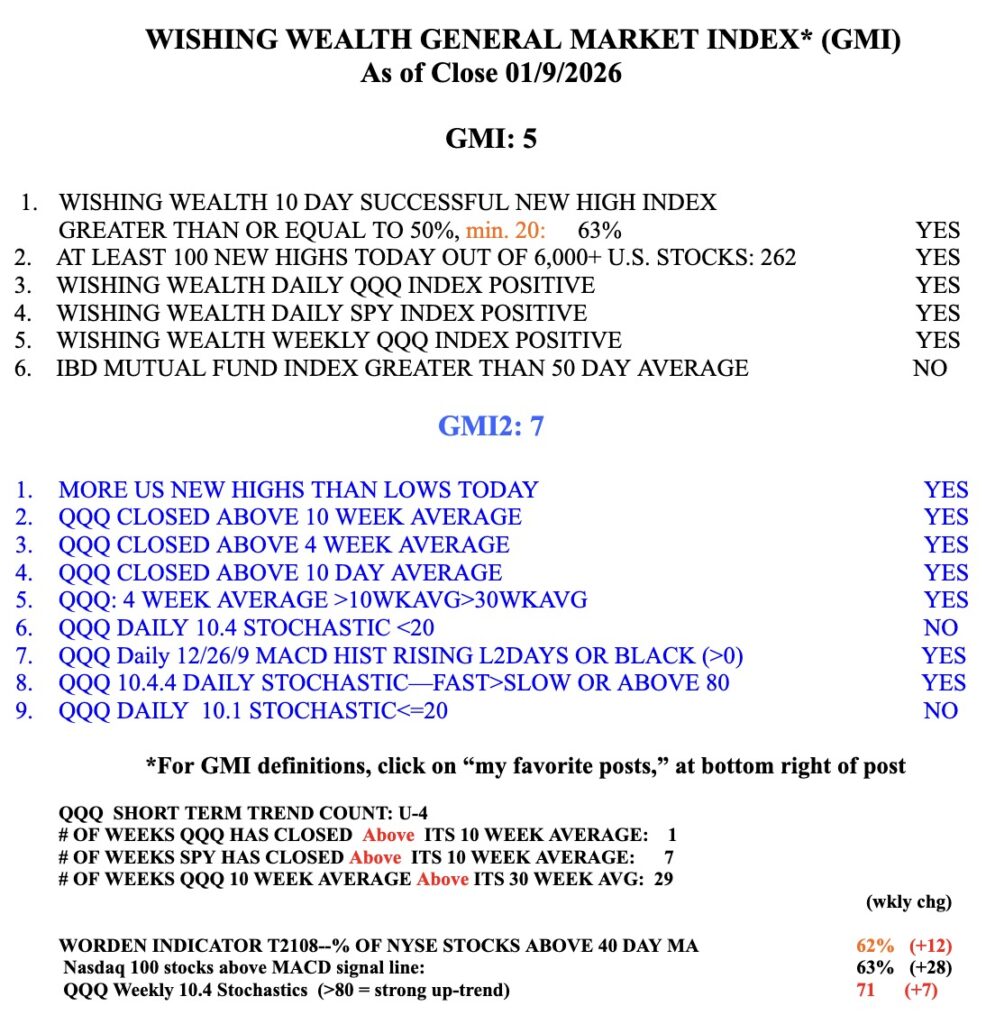

The GMI remains GREEN but note that the more sensitive GMI2 is weaker.