From time to time I attend stock meet-ups and listen to members opine about how useless the IBD 100 lists are. People just like to denigrate things without examining the evidence and these untruths tend to get passed on unchallenged. Each Monday, IBD publishes a list of the top 100 growth stocks that meet their technical and fundamental criteria. I feel a lot more confident buying stocks on this list because IBD’s stock selection criteria are based on analyses of their comprehensive database of the best stocks over the past 100 years. Imagine that–they actually analyzed the characteristics of past market winners to design an empirically based system for selecting winners BEFORE they take off. Because human trading psychology is pretty stable, one can discern lasting technical patterns (which are really trading decisions) that are characteristic of winning stocks.

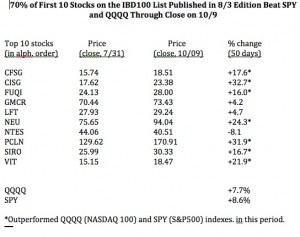

So, one of the exclamations that I have heard from self-proclaimed experts is that by the time that a stock gets to the top of the IBD 100 list, it is too late to trade it for a profit. The table below shows this assertion to be nonsense, at least for the top ten stocks on the list published on

August 3, 2009.  70% of these ten stocks that were at the top of the IBD 100 list outperformed the QQQQ and SPY, through last Friday. (TYH, the ultra 3x technology ETF, went up 25% during this period, again showing the advantage of riding these ETF’s over individual stocks. ) While it is true that some of these 10 stocks declined before they recovered, it is clear that many of them ended up doing quite well over the past 50 days after August 3. A similar analysis of the top ten stocks from the list published on July 27 also showed that 70% beat these two averages. The best 2 were CISG (+28%) and FUQI (+26.8%), with NTES again being the one loser (-4%). It looks to me like the top ten stocks on the IBD100 list may be worth investigating for potential buys….

70% of these ten stocks that were at the top of the IBD 100 list outperformed the QQQQ and SPY, through last Friday. (TYH, the ultra 3x technology ETF, went up 25% during this period, again showing the advantage of riding these ETF’s over individual stocks. ) While it is true that some of these 10 stocks declined before they recovered, it is clear that many of them ended up doing quite well over the past 50 days after August 3. A similar analysis of the top ten stocks from the list published on July 27 also showed that 70% beat these two averages. The best 2 were CISG (+28%) and FUQI (+26.8%), with NTES again being the one loser (-4%). It looks to me like the top ten stocks on the IBD100 list may be worth investigating for potential buys….

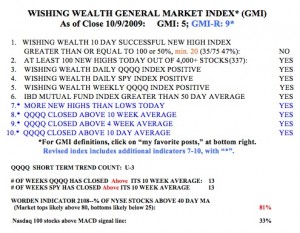

Meanwhile, the GMI is at 5 and the GMI-R is at 9. A lot of stocks are breaking out as we go into option expiration this Friday.  It never ceases to amaze me how the pundits focus on questioning the viability of the up-trend instead of riding it until it ends. When they all do jump on the bandwagon, it will probably be time to get defensive.

It never ceases to amaze me how the pundits focus on questioning the viability of the up-trend instead of riding it until it ends. When they all do jump on the bandwagon, it will probably be time to get defensive.

Dr Wish,

Any yellow banding stocks worth noting?

Jason

Plenty: PEGA, EMS, SXCI, LZ to name a few I own. We are getting over 500 new highs some days. It is therefore now more difficult to pick out the true winners. But a rising tide raises all ships! I have had a very profitable run riding TYH. If one can accurately pick the onset of an up-trend, TYH is the way for me.

You’re right. Evidence is important.

I have the lists from the lists conception in 2003 to present. I just ran a test with “All Start Days” — 21 start dates — and a hold of the top ten positions for 4 weeks. The results for this full period are:

1. The strategy peaked on 5/10/2006 and bottomed on 3/11/2009.

2. The compound annual growth rate was 5.4%. The S&P 500 has a CAGR of 5.52% over the same period.

3. The Geometric Standard Deviation, however, was double that of the S&P 500 at about 46, compared to 23 for the SP500.

4. Daily Maximum Drawdown was -75% — you most definitely do need a way to get out of the market during bearish periods. Holding these ten stocks when the market is tanking will kill any allegiance you may have to stock trading.

Hey are using WordPress for your blog platform? I’m new to the blog world but I’m trying to

get started and create my own. Do you require any

html coding expertise to make your own blog? Any help would be greatly appreciated!

I use WordPress. My son set up the page and I have no html experience.