These 13 stocks hit an ATH last week and survived my weekly green line scan for technically strong stocks in an up-trend. They all hit 20 week highs in relative strength vs. SPY last week. The third column divides current price by its price 250 days ago. Thus LNTH has almost tripled, 2.87 and AMR is up almost 9x. SLVM has a null result because it did not exist 250 days ago. It is an IPO break-out stock and recently successfully tested its GLB. See weekly chart.

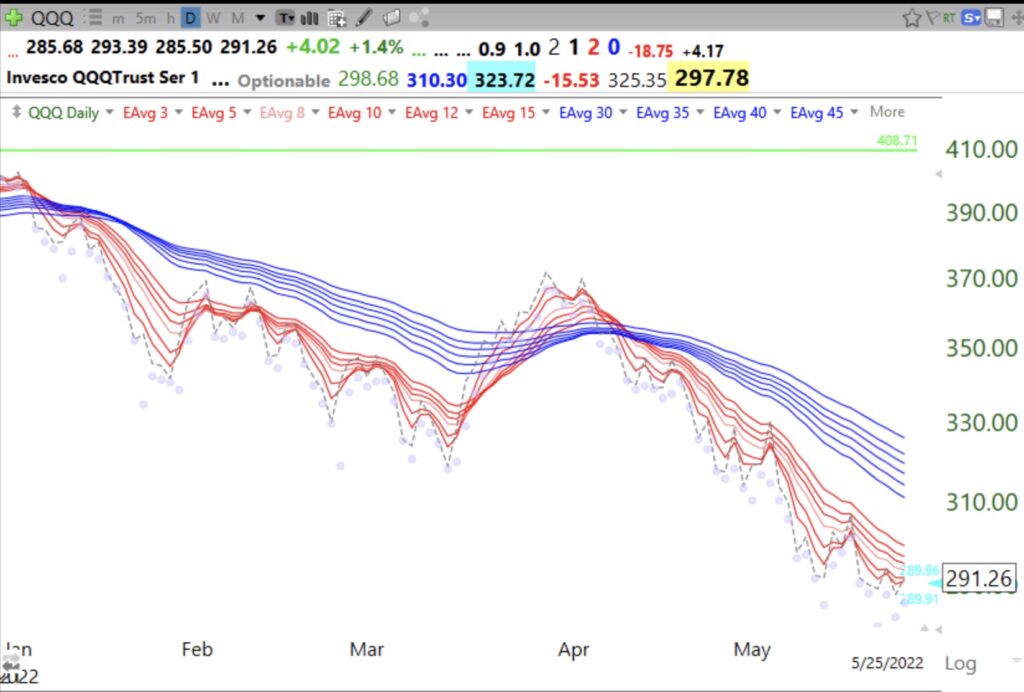

QQQ remains in a Stage 4 down-trend. The 30 week average (red solid line) needs to curve up for me to bank on a new up-trend. That is a long way off. Beware of possible sharp bear market bounces.