Green lines are recoded orange when a higher green line is drawn.

Stock Market Technical Indicators & Analysis

Green lines are recoded orange when a higher green line is drawn.

Note the Blue Dot signal and the bounce up off of the 8 EMA. Learn about the Blue Dot of Happiness indicator at the link in my May webinar tab on this blog. The N means I have entered a note after trading this stock.

The purpose of this revised table is to show selected successful GLBs. I sorted it by date and added more GLBs in 2025. I want readers to understand that a green line break-out (GLB) to an all-time high after a 3 month or more rest can be a great place to purchase a stock. A GLB can signal the beginning, not the end of a big move. If the stock closes back below the green line it is a failed GLB, and I sell it immediately, and may repurchase it if it closes back above the green line. The change in the stock since the GLB is updated automatically in this table on my blog throughout the trading day.

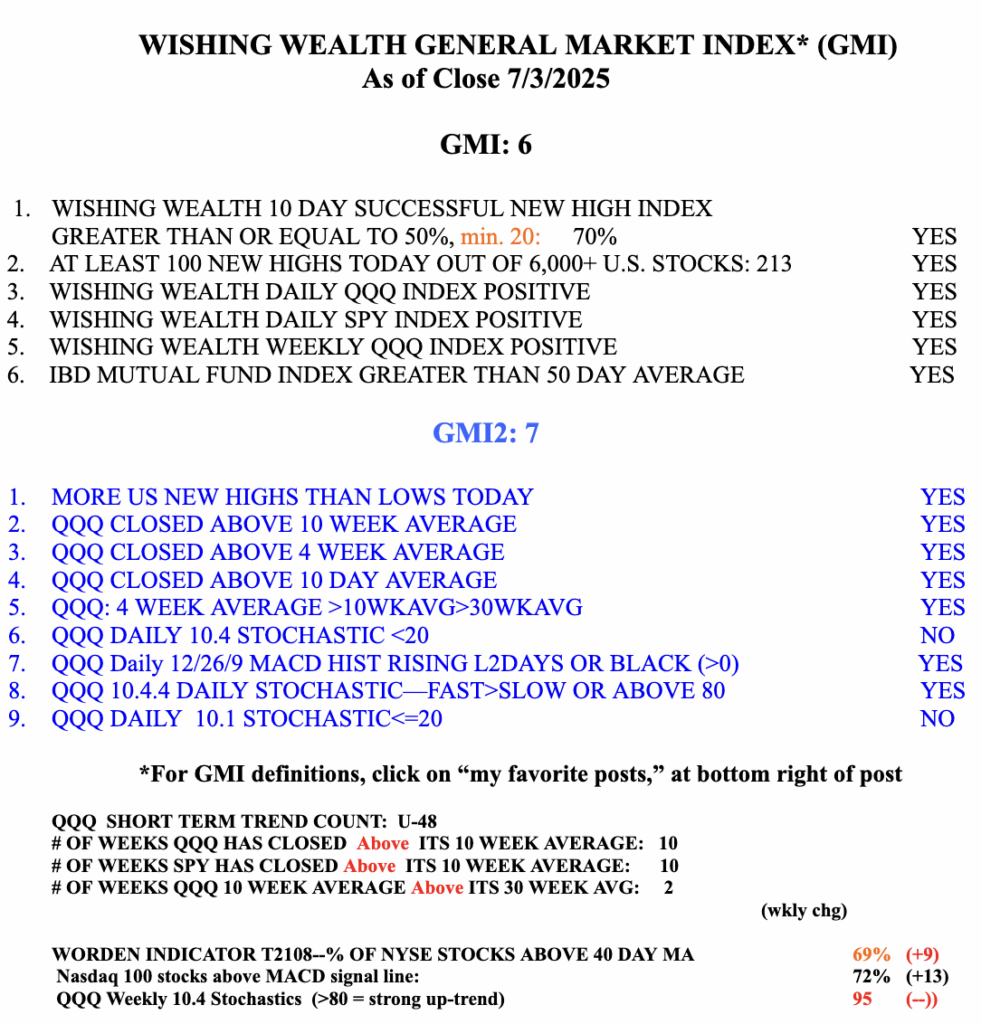

The GMI is Green and 6 (of 6).