Friday was considered to be a follow through day, FTD, as defined by William O’Neil. An FTD is necessary but not sufficient for a new bull market to begin– every new bull starts after a FTD but not every FTD leads to a new bull market. There have been several failed FTDs lately. So we must wait and see.

In the mean time, a number of stocks came up on my ATH scan: INSW, LLY, MRK, CI, COP, CDRE, NOC, XOM and BAH. These are all on my IBD/MS recent watchlists. After its huge gap up on 9/28, LLY finally went to an ATH on Friday and bears watching, given its promising drug pipeline.

One stock at an ATH not on that watchlist, that I own is SGML. Its weekly chart has a weekly green bar and 4wk>10wk>30wk pattern. Lithium will be needed for all of those coming EV batteries. As long as it closes each week above its 4 week average I will hold it. Note the recent heavy volume.

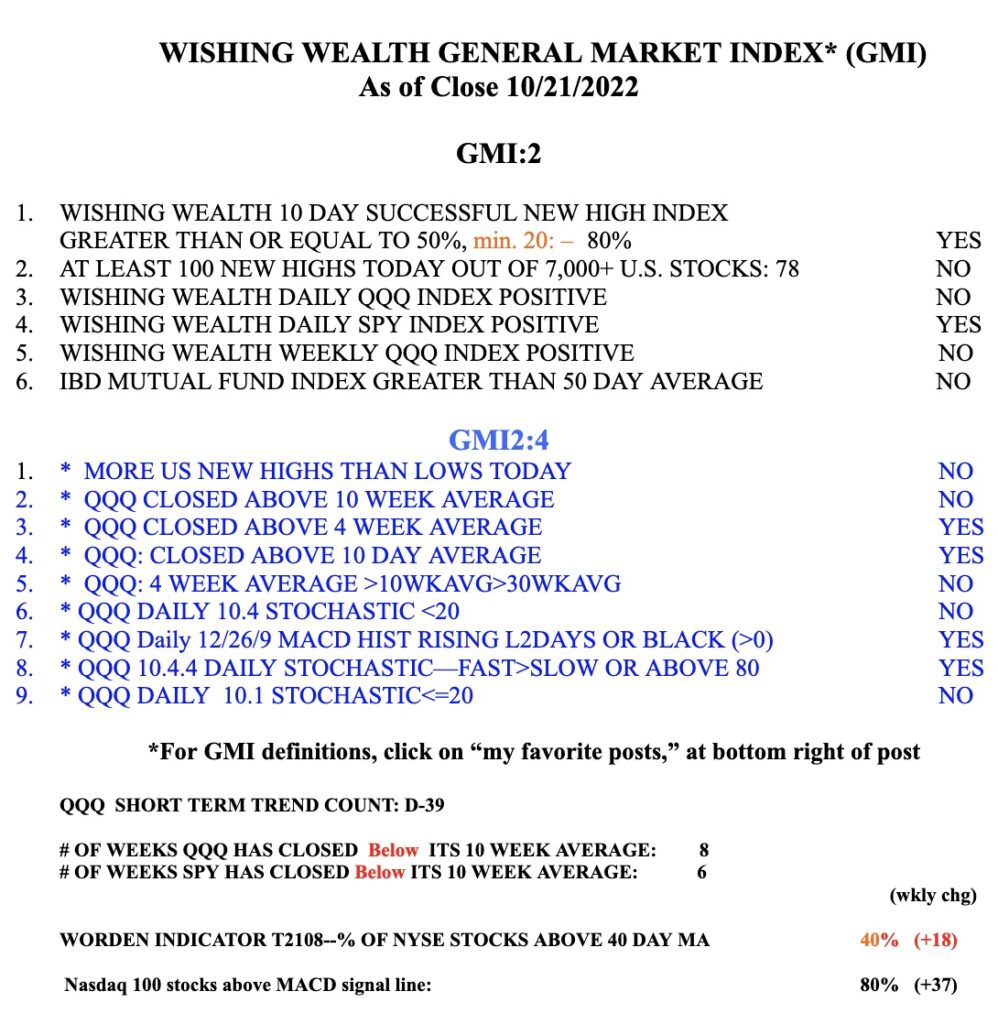

The GMI remains Red.