As you know, I like to buy stocks that have moved to an ATH (all time high) have then rested, and then moved up to a new ATH. That is the strategy of the greatest traders I follow. I draw a green line at the stock’s peak once it has not been surpassed for a least 3 months. When the stock stops resting and moves above the green line, a GLB or green lie break-out, I consider buying and holding unless the stock CLOSES back below the green line. I say closes because many times the stock trades below the green line intraday only to close back above it. If the stock closes below the green line, it is a failed GLB and I exit immediately. If it retakes the green line and closes back above it I buy it back. Sometimes this dance goes along for a while until the stock finally takes off, often without me, as occurred with WING. When I draw the green line I immediately set an alert in TC2000 good for one year to tell me immediately when/if the stock trades back above the green line. I and some of my former students then receive a text from TC2000 informing us of the break-out. After WING came up on today’s ATH scan I looked at my alert log and found the following.

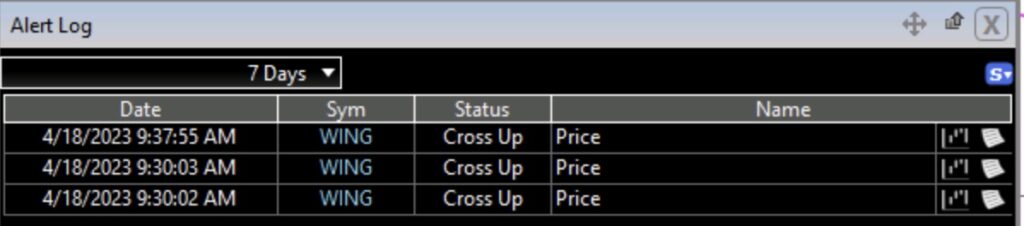

On April 18, I received 3 alerts because WING had crossed above its green line! Three alerts, because I had mistakenly set multiple alerts over several weeks whenever I would look at a chart of WING. I am embarrassed to admit that I NEVER saw these alerts until today! I was too busy with other things and too down on how the market was behaving. Hopefully, some of the people who receive my alerts benefitted from these alerts.

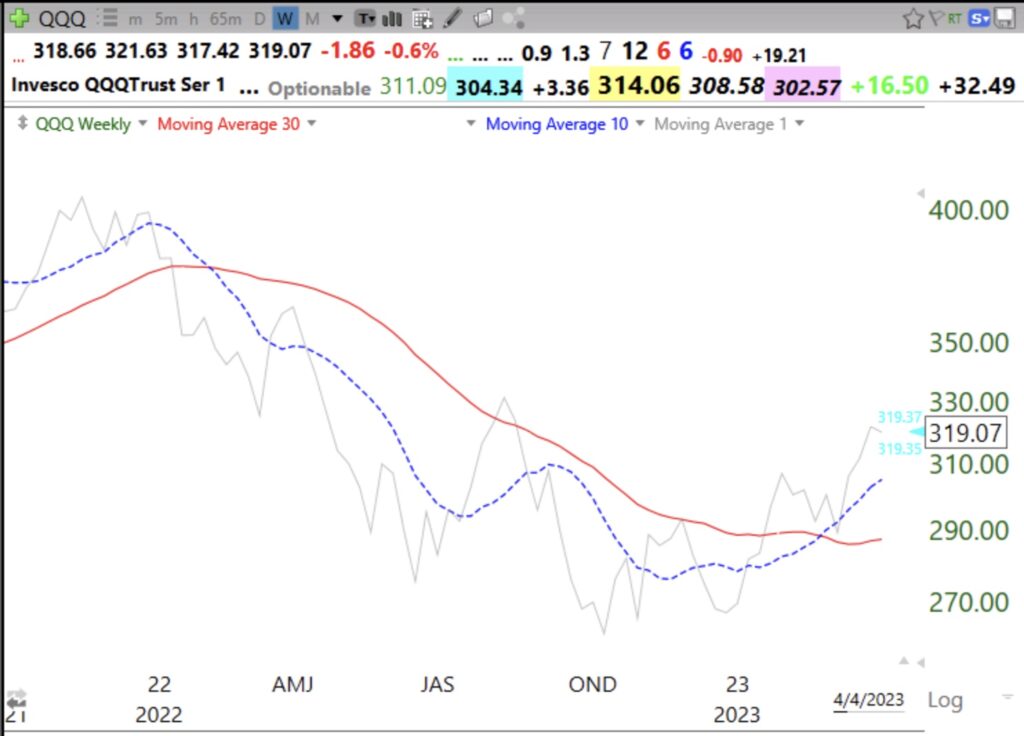

The daily chart below shows the day of these 3 alerts. Note several prior failed GLBs. On March 18 WING closed above its green line ($187.35) and closed the next day at $187.43. Then it was off to the races. Note the above average volume on March 18 and today–good signs. The train has left the station.

So what can you learn from my miserable mistake? It is salt in my wounds because I had bought and sold WING several times in March and incurred small losses. The famous Turtle Traders (book appears at bottom of this blog) had a rule that said they had to act on every buy signal. The one signal you do not take after several fails is often the one that works. I do not know if WING will continue to fly. If I owned it I would sell if it closes back below the green line. And earnings are coming up on May 3. The last time earnings were released was in February when the stock gapped up and rose above the green line but then failed. The key is to continue to monitor stocks for a break out and not let your emotions or other things get in the way. Perhaps you can learn from this example and my rules below how to trade GLBs. Some, not all, may work out if you buy them on the day of the GLB. Look at this shining example of APLS.

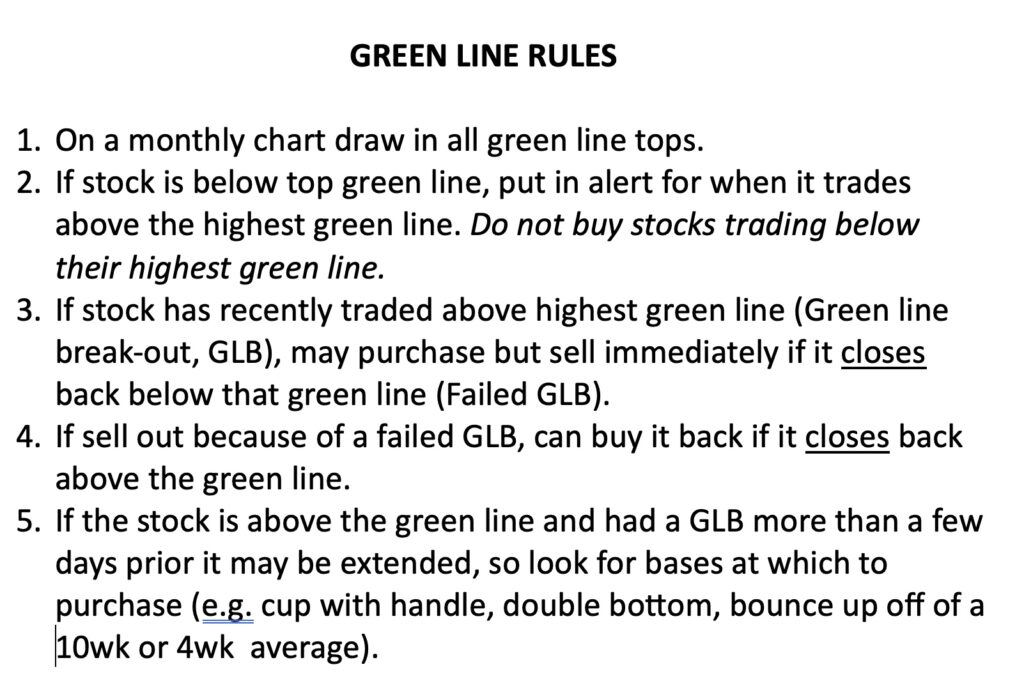

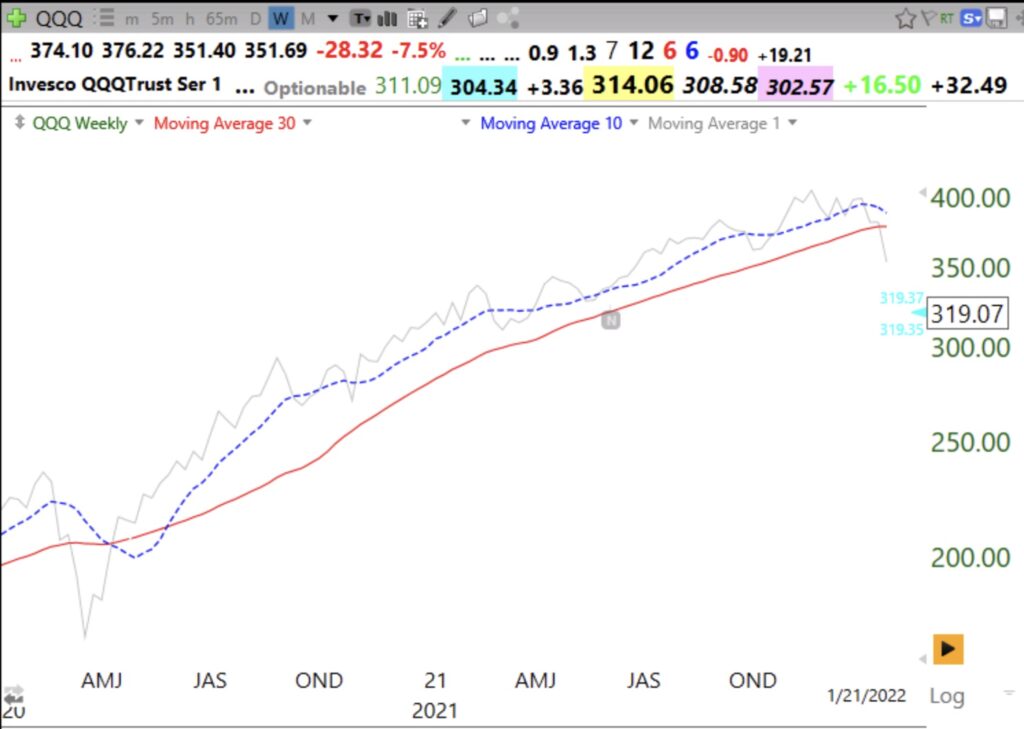

Don’t waste your time trading the fallen angels trading well down from their all time highs. Focus on those climbing to new heights. That is what Darvas and O’Neil did. Check out their charts of their biggest winners and you will see. In a weak market you have very few stocks trading at ATHs. Those that do can turn out to be the new leaders. Below are my green line trading rules for my students.