These stocks from my IBD/MarketSmith watchlist had an oversold bounce (OSB) on above average volume on Monday. But with the GMI Green in the midst of QQQ in a short term down-trend, bounces may not hold. We must be very careful during this bifurcated market.

Dr. Wish

Dr. Wish

Blog post: GMI rebounds to 4 and could turn Green on Monday; However, $QQQ closed below its 10 week average. Critical week coming; $CROX $YETI $PLBY have black dots signaling OSBs

A large number of stocks had an OSB (oversold bounce) on Friday, 56/602 IBD/MarketSmith type growth stocks and 166/6222 of all US stocks. So did DIA and SPY. It remains to be seen whether these bounces will hold. Here are a few examples. Note the black dots indicating an OSB. They all recently traded at ATHs (all-time highs).

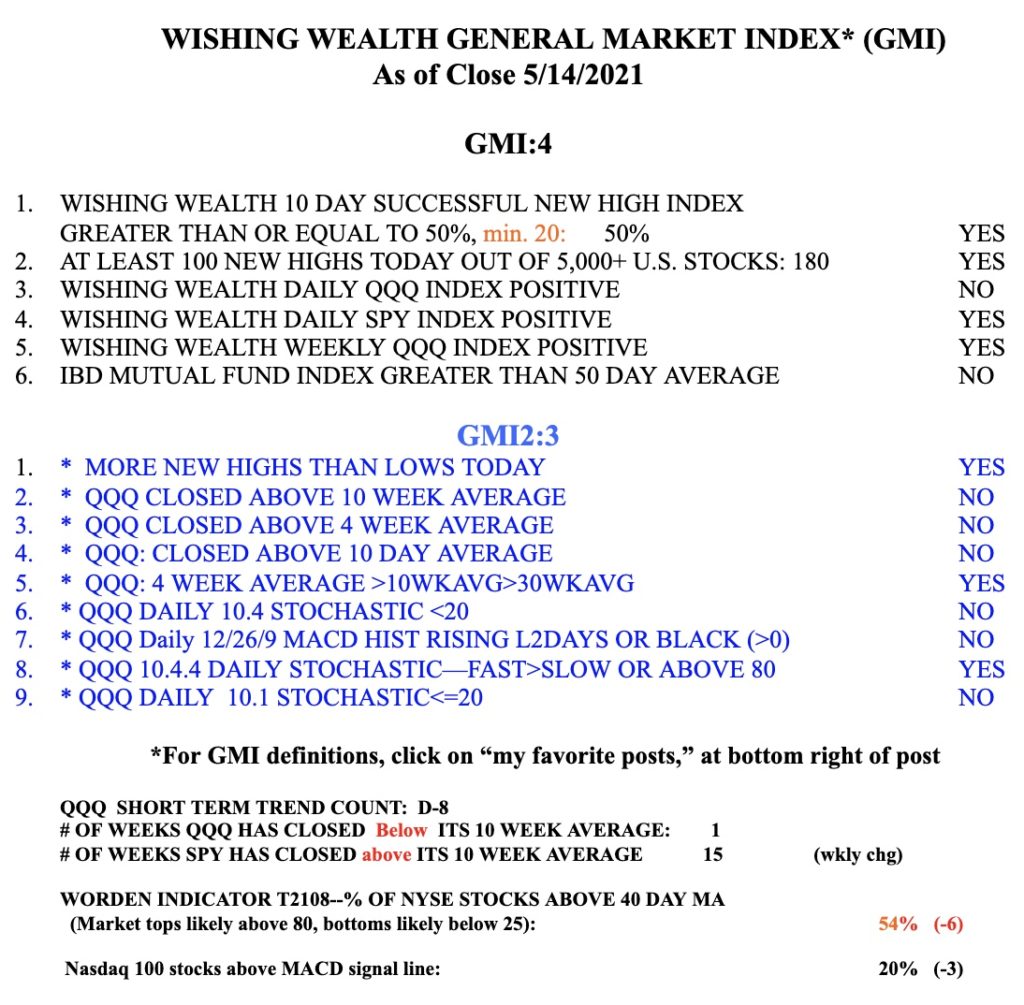

The GMI rose to 4 and could turn Green if it closes above 3 on Monday. The key is to wait until it happens and to resist acting in advance of the signal, which may not come. The QQQ completed its 8th day (D-8) of its short term down-trend.

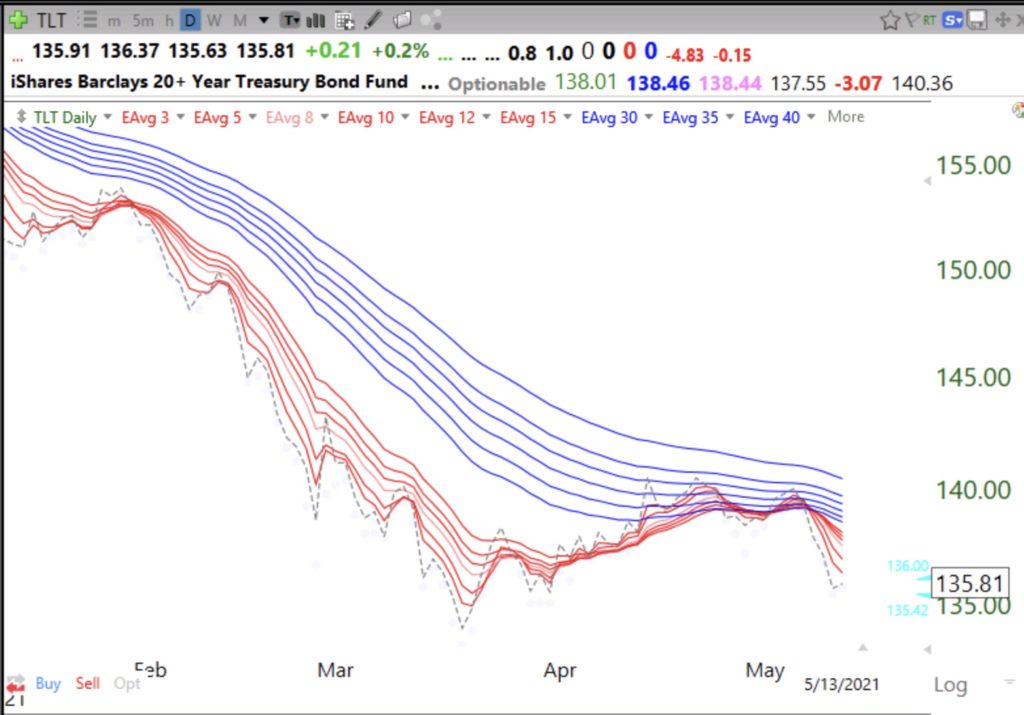

Blog post: 7th day of $QQQ short term down-trend; treasury bonds resuming daily BWR down-trend leading to higher interest rates and an end to the bull market; Sell in May?!

Higher interest rates always kill the bull. They increase the costs of doing business, slow the economy and give people an ability to abandon risky stocks and to earn decent income from safer interest paying investments. How nice it will be for Boomers to be able to get good interest rates from safer insured CDs. Higher rates will suck the money out of the stock market. Sell in May looks pretty timely this year. The charts will tell us what to do.