One of the signals of a possibly weakening market is that stocks that have broken out fail and return below their break-out points. Among the stocks that did so recently are PJC, AMZN, GS and WB. And while it was not a GLB to an ATH, TSLA also faltered last week. Sure there are still plenty of successful break-outs, but we need to heed when the leaders can’t surge higher. I also remain concerned that the major indexes are floating above their 4 week averages. This weekly chart of SPY provides an example. The red dotted line is the 4 week average. Usually the index will return to at least kiss its 4 wk average.

Nevertheless, among the stocks that came up in my scan for stocks up on high weekly volume and that also proved to be GLB, were VAC, OLED and SP. Check out these weekly charts and their unusually high volume. All have good recent earnings and may be worthy of further research. You can run this scan (11252016……) yourself by joining my TC2000 club: www.wishingwealthblog.com/club. But we must be vigilant for failed break-outs……

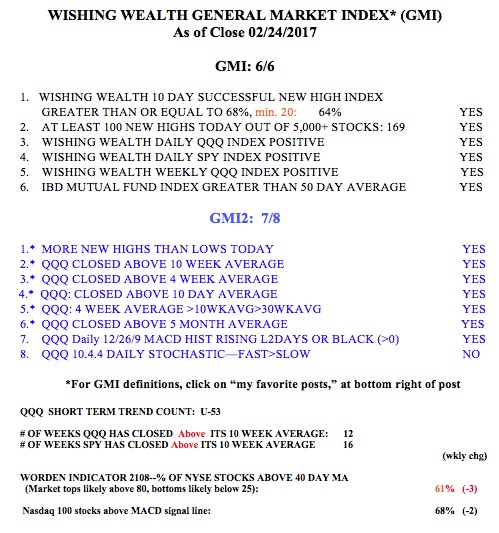

The GMI remains at 6 (of 6).