It took me a long time to understand the wisdom of Nicolas Darvas and William O’Neil’s advice to always trade in synch with the overall market’s trend. I learned the hard way that the same buy set-ups and rules that worked in a rising market failed repeatedly in a declining market. That is why I go short or retreat to the sidelines when my indicators, summarized in the General Market Index (GMI), lead me to issue a Sell signal. The last Sell signal occurred on December 10, 2015. Since then I have been mainly in cash. I find it very difficult to stay in and trade on the short side, and leave that strategy to younger people with greater ability to handle the risks and losses from shorting.

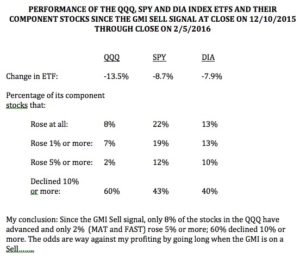

I decided it was time to assess once again whether following the most recent GMI signal was an effective strategy. This table leads me to conclude that it was. As William O’Neil has taught, most (about 70-80%) stocks follow the trend of the general market averages. During the period since the December GMI Sell signal, between 78%-92% of the stocks in the three ETFs I follow most closely declined through last Friday. Because many of the GMI components are based on the action of the QQQ, it is not surprising to me that the QQQ and its component stocks performed the worst since the GMI Sell signal; the QQQ declined -13.5% and 92% of its component stocks declined, 60% fell by 10% or more, since the day of the GMI Sell signal. But all three index ETFs have declined since then and the overwhelming majority of their component stocks have also declined.

I know the media pundits say one cannot time the market, but the GMI has gotten me out of the major market declines since 2000 and back in during the recovery. I never worry about missing the market’s eventual recovery. If I get back in lower or even equal to where I exited, I did well enough and avoided a lot of mental anguish…

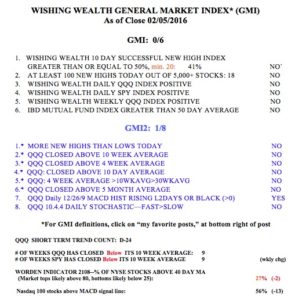

Speaking of the GMI, it remains at a 0 (of 6) and I remain in cash.

My AAII workshop is February 20, register here.

Enjoy your signals……..I would like to find out the dates of your GMI buy and sell signals going back to 2000, if possible………..I’m going to meet with our investment group next month and would love to display your signals and results…………..Should be about 30-45 people and I know this would be something they could use………….Thanks much……….Rc…………..

Dr. Wish, your analysis is accurate!! The stock RTN must be among the 2% rising in this down market. RTN is back and above its value of last Dec. !!