Since 2006, 76% of the QQQ short term down-trends that lasted 5 days, eventually lasted for 11 days or more. I am therefore content to remain mainly in cash with a small position in SQQQ. SQQQ is an inverse ETF which is designed to rise 3X as much as QQQ falls. The Dow 30 stocks are much weaker than the Nasdaq 100 or S&P500 stocks. One half of the Dow stocks are below their critical 30 week averages, compared with about one third of the stocks in these other indexes.

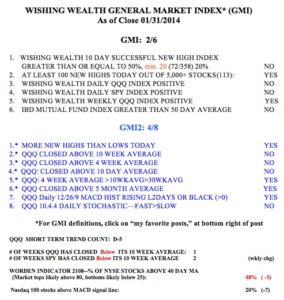

The GMI flashed a Sell signal as of the close on 1/27 and registers 2 (of 6).

Hello Dr. Wish

In your experience, when seeing that the Dow 30 is declining more rapidly that the Nasdaq, is it more profitable to short the Dow, say by purchasing the DXD?

Or, is it more likely that if the markets continue to decline that the Nasdaq would eventually catch up to the Dow decline?

I enjoy reading your comments each morning, thanks much for posting your thoughts.

Mike in Dearborn MI

Thank you!

wonder the same as mike