The market is not out of the woods. IBD still calls it in a correction. And the GMI is only 1 (of 6). The market is no longer oversold. I am watching AAPL for clues of the market’s trend. A close of AAPL above 591 would suggest significant strength. But its 10 week average is about to cross below its 30 week average, a sign of weakness.

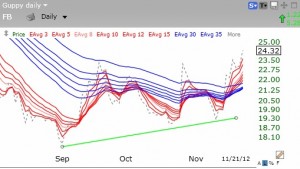

Meanwhile, FB continues to show strength, now closing at $24.32. The daily Guppy GMMA chart shows that the short term averages (red lines) are now rising above the long term averages (blue lines), a major sign of strength. I own some FB.