A large number of stocks had an OSB (oversold bounce) on Friday, 56/602 IBD/MarketSmith type growth stocks and 166/6222 of all US stocks. So did DIA and SPY. It remains to be seen whether these bounces will hold. Here are a few examples. Note the black dots indicating an OSB. They all recently traded at ATHs (all-time highs).

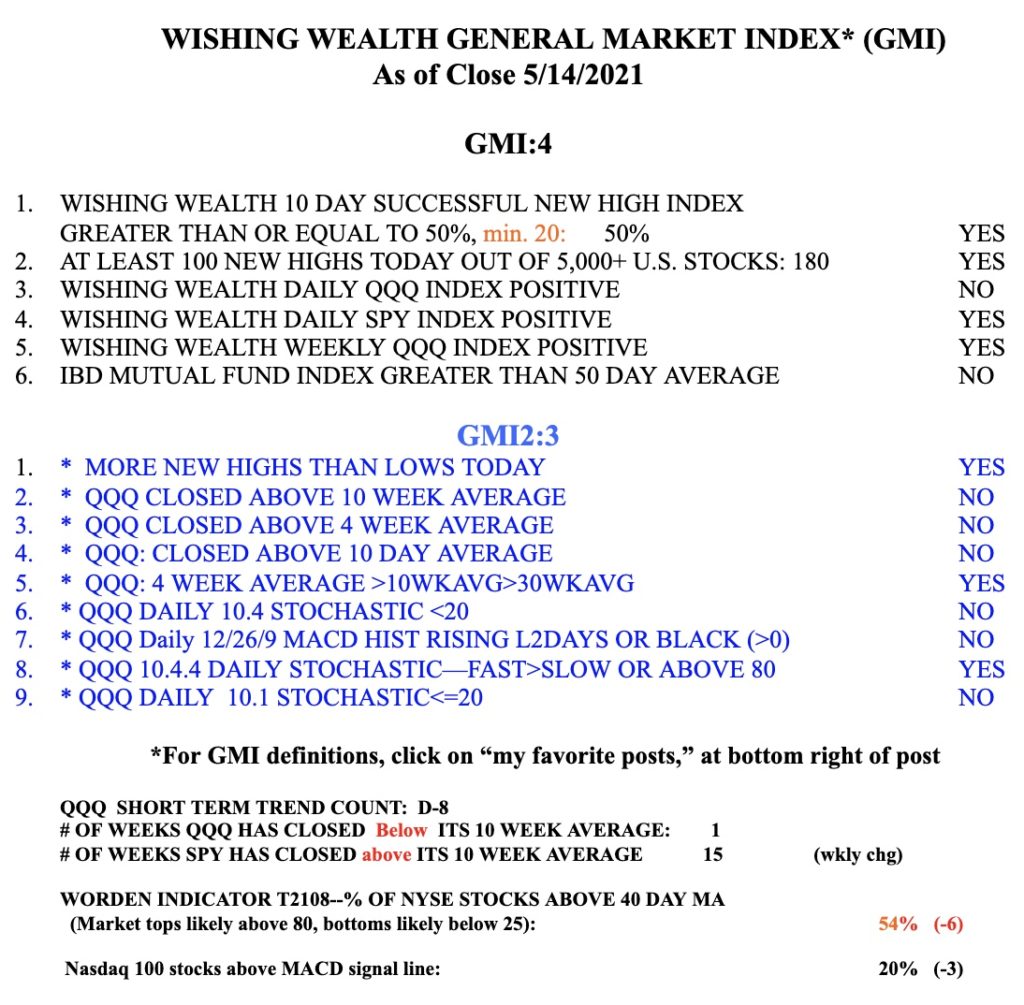

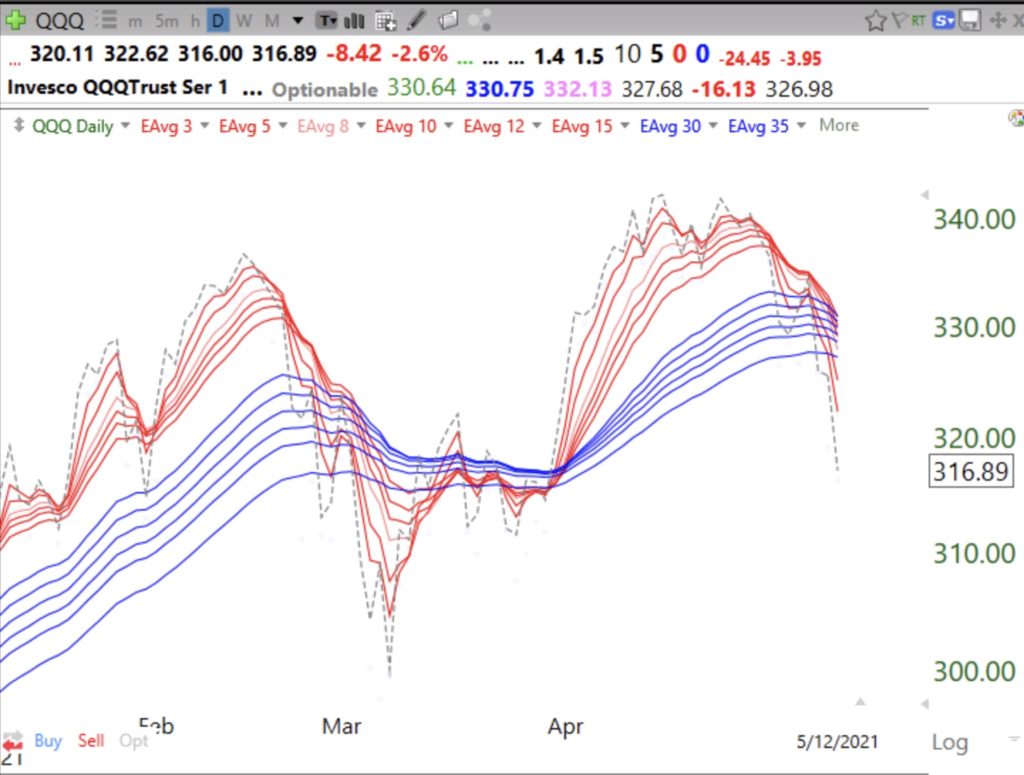

The GMI rose to 4 and could turn Green if it closes above 3 on Monday. The key is to wait until it happens and to resist acting in advance of the signal, which may not come. The QQQ completed its 8th day (D-8) of its short term down-trend.