SMCI had a wonderful GLB on January 19 and rocketed higher. However, note the huge volume on the down day on Friday. This could reflect a similar overbought situation with other high flyers. Be careful. We have had a strong market during the release of 4th quarter earnings. I suspect we are likely to have some weakness into late March until first quarter earnings are upon us. For now, I have close sell stops on my positions. I am unlikely to add anything new now but will look to buy future oversold bounces on any significant market weakness.

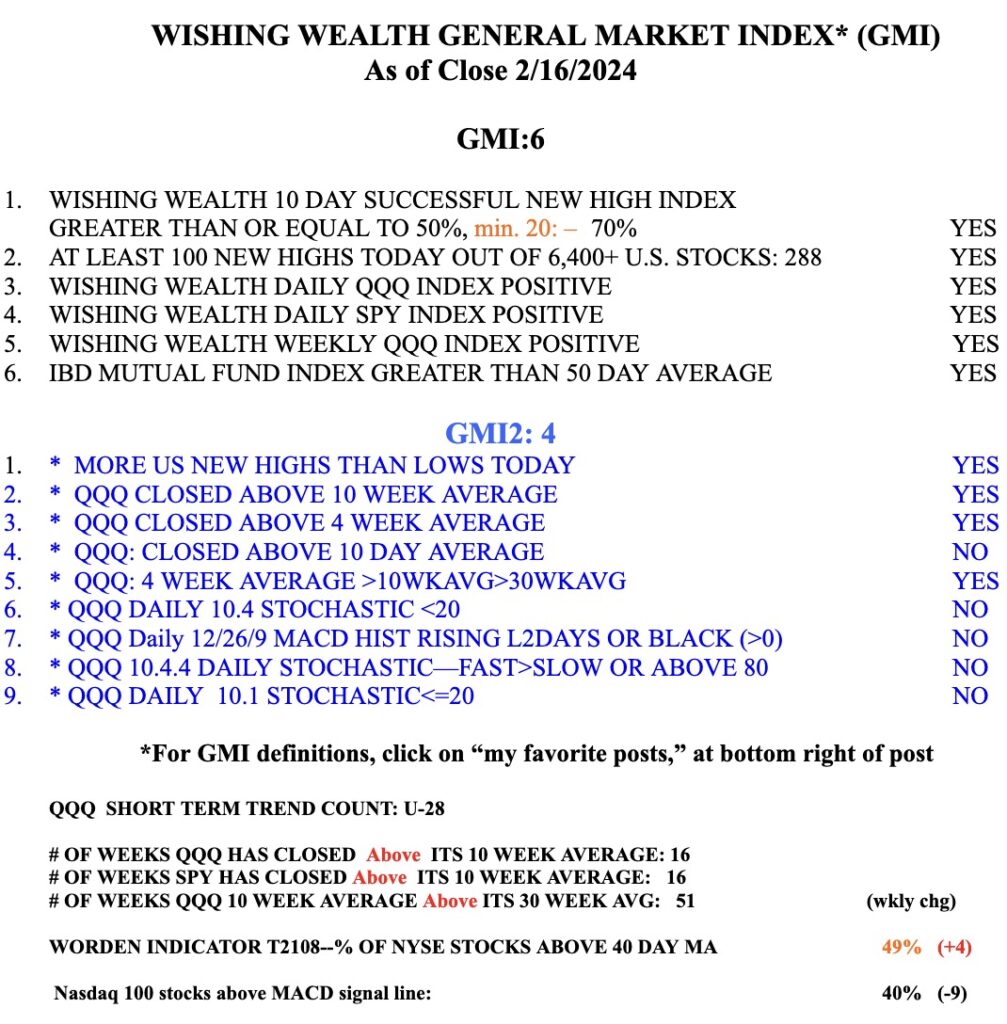

General Market Index (GMI) table

Blog Post: Day 23 of $QQQ short term up-trend; $NXPI retakes green line; $GBTC has blue/green/black dots signaling bitcoin rise, see charts

NXPI had a failed GLB but closed back above the green line on Friday. Note all of the black dots and the recent green dot. To remain a successful GLB it must not close below the green line, @228.72.

Note the 3 dots on January 26 for GBTC. To understand the dots you must go to my recent IBD Meetup lecture recording.

The GMI remains Green and registers 6 (of 6). Don’t forget to check out the GLB Tracker table and subscribe to receive my blog posts in your inbox.

Blog Post: Day 18 of $QQQ short term up-trend; only 31% of US stocks and 56% of Nasdaq 100 stocks rose on Friday and T2108 declined=weakness under the hood

My scan found only 2 growth stocks having oversold bounces with blue dots on Friday (WSM and MUSA). I will ride my strong stocks but wait for more stocks with blue dots to appear to make new buys. The strong AI related stocks may be masking weakness in the general market. The GMI remains Green and registers 6 (of 6).