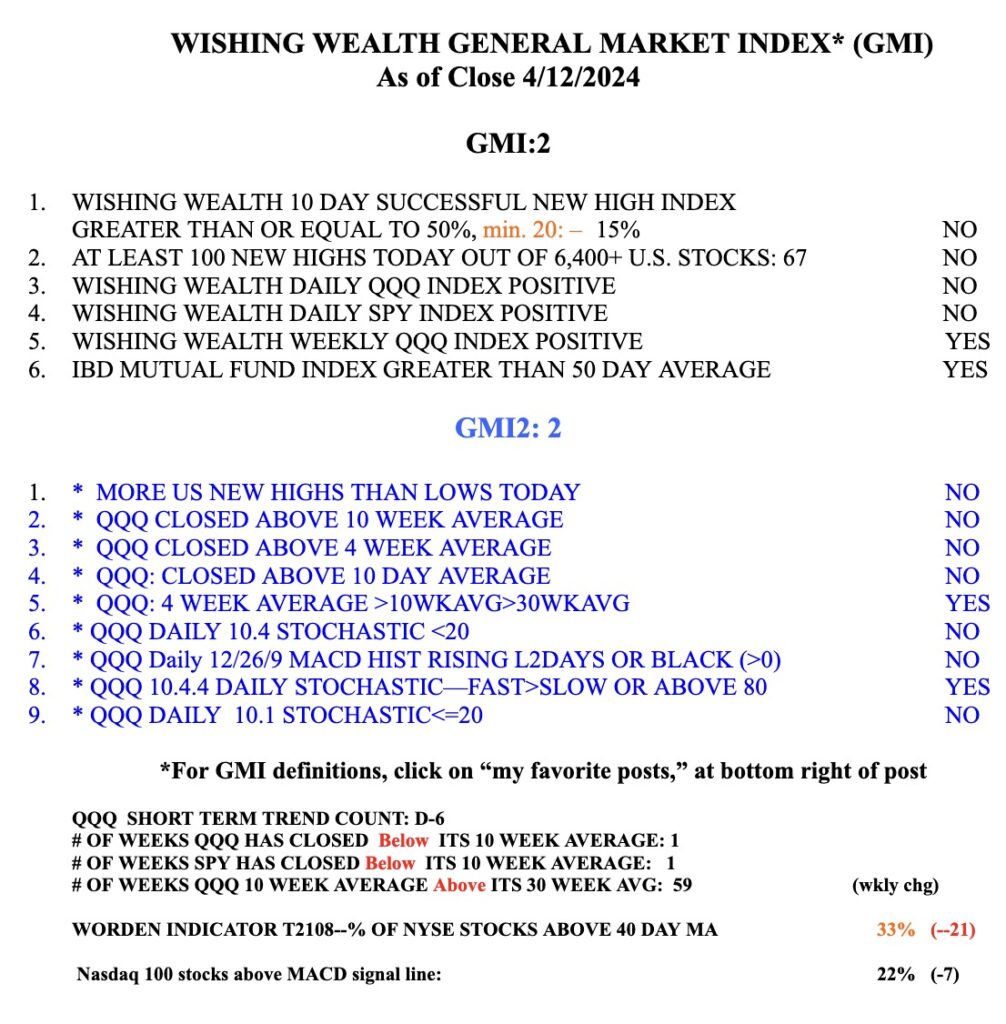

QQQ has broken below its recent support level on above average volume. DIA and SPY are equally weak. Support may be around 405 or the green line at 408. This is the time for me to be on the sidelines in my trading accounts. The longer term trend remains up but the GMI has turned RED. If the GMI hits zero, I will begin to transfer my conservative retirement funds from mutual funds into money market funds.