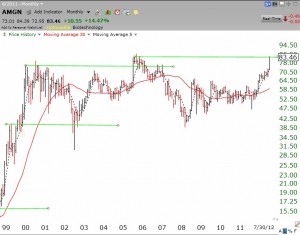

Monday was the first day of a new QQQ short term up-trend. The prior down-trend lasted only 3 days. This has been a very erratic market. I am more confident of a change in trend after it has persisted for 5 days. So I am slowly wading back into this market. Keeping an eye on AMGN. This monthly green line chart shows AMGN is about to break out of a multi-year base to an all-time high.

Month: July 2012

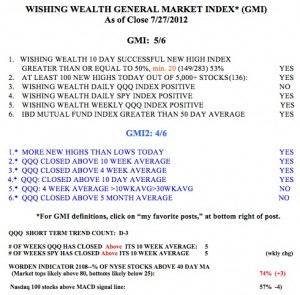

GMI rebounds to 5; can market hold? SSYS, SRCL green line charts

The GMI has rebounded to 5 (of 6) and if it holds on Monday, the GMI will give a buy signal.  The market has been erratic and IBD switched to “market in a confirmed up-trend” last last week. I closed out my shorts and have made a few buys. This could merely have been end-of-month buying and it will be interesting to see if August will hold the gains. After earnings are out, the market often calms down until the beginning of the next quarter’s earnings announcements, sometime in late October or November. Remember, the Sell in May slogan says to buy back into the market around Halloween……

The market has been erratic and IBD switched to “market in a confirmed up-trend” last last week. I closed out my shorts and have made a few buys. This could merely have been end-of-month buying and it will be interesting to see if August will hold the gains. After earnings are out, the market often calms down until the beginning of the next quarter’s earnings announcements, sometime in late October or November. Remember, the Sell in May slogan says to buy back into the market around Halloween……

I introduced green line charts last week. I scanned for stocks hitting a new high Friday and created green line charts for most of them. I am looking for a stock that hit a 52 week high and is breaking out of a multi-month base towards an all-time high. An example of what I am looking for is shown in this monthly green line chart of SSYS. This stock is probably worth researching. One important factor to look for is the next earnings release date. Click on chart to enlarge.

SRCL is one of those stocks hitting a 52 week high that is just below its green line top ($95.71). I placed an alert in TC2000 to tell me if SRCL trades above 95.

Major rally underway–slowly going long

I reversed my positions and began going long. It looks like the recent 3 day decline was a just a fake-out. A lot of stocks are breaking out. I must not marry a market scenario. I must be nimble and go with a likely change in trend. I am buying some QLD and will add to it if it rises. I also bought some DDD and PCYC. No guarantees. I will add slowly if a stock acts as predicted. Will this bounce last???