Since the GMI flashed a by signal on December 23rd, the QQQ has advanced +7.8%, the QLD +16% and the TYH +24.7%. In the same period, 30% of the Nasdaq 100 stocks have advanced 10% or more and only 5% have advanced more than 23%. Yet again, we find that riding a triple leveraged ETF in an up-trend beats almost all other stocks. Why do we search for the rare stock that will outperform the 3X leveraged ETF , like TYH! Another leveraged ETF that did as well as TYH during this period is TQQQ. In fact the leveraged ETF, SOXL, advanced +34.4%!

Month: January 2012

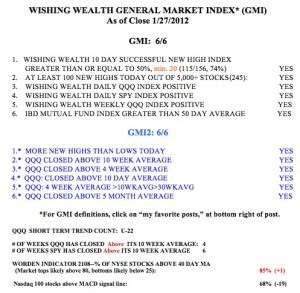

22nd day of QQQ short term up-trend

GMI remains at 6 (of 6). T2108 is still in overbought territory, as is the QQQ daily 10.4.4 stochastics, now at 86. Gold (GLD ETF) still appears to be headed higher. With earnings season almost over, we could enter a period of retracement and consolidation. The key is to wait for a signal rather than to act in advance.

21st day of QQQ short term up-trend; GLD breaks down-trend

The up-trend in the QQQ continues. I have written about the probable down-trend in gold, as measured by its ETF, GLD. However, you can see from this daily chart that GLD broke its down-trend on Wednesday on above average volume. Since I already own an in-the-money put option on GLD, I have purchased 100 shares of GLD, which are now protected by my put option. When I buy an in-the-money put option, and the stock reverses, I can always just buy the shares and keep the put option as insurance against a resumption of the down-trend. If the stock resumes its down-trend I can just sell the shares and retain the put option. Click on this daily chart of GLD to enlarge.