Another up or flat day on Wednesday will change my QQQ short term trend count to an up-trend. Tuesday was the 20th day of the current short term down-trend. The longer term trend remains down. September is typically the worst month of the year for the market, so I would not be surprised to see a decline start soon. By the way, I am not concerned that the market is rising on sluggish volume. The multi-month rally that began last September also came on below average trading volume. Check out this monthly chart of the QQQ (click on chart to enlarge).

Month: August 2011

19th day of QQQ short term down-trend

We are nearing the place when the averages come up against major resistance. The outcome will determine whether this counter-trend rally turns into an up-trend or ends with a continuation of the down-trend.

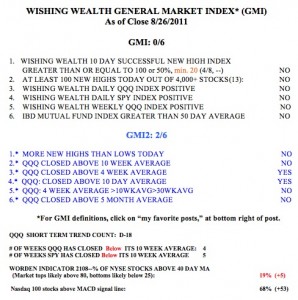

Market remains in down-trend as GMI2 rises to 2 (of 6)

I am still waiting for to see whether this base will hold. Friday was the 18th day of the QQQ short term down-trend. The longer term trend remains down. It is very tempting to nibble at stocks that are rebounding. The problem is that the decline could resume quickly for such stocks. It is much safer to own stocks when the GMI is at least 4. With the GMI still at zero, I will let the bottom feeders get in before me. When my indicators signal a true up-trend, I will get back in. A trend follower always waits for a trend to develop and therefore identifies bottoms and tops after they have been established. The GMI2 contains several more sensitive short term indicators which can turn up in a counter-trend rally during a down-trend. Friday was the 18th day (D-18) of the current QQQ short term down-trend. Only 2 of the 9 leaders I follow have closed above their critical 10 week averages: AAPL and AZO.