With the end of the quarter today, I am watching carefully to see if we will get a short period of October swoon before earnings start coming out. While my indicators are all positive, note the T2108 is 84%, a high reading typical of an overbought market.

Month: September 2010

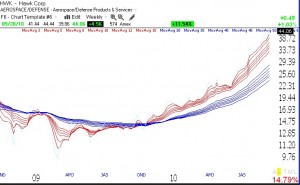

Air pockets in 2 leaders on Tuesday; RWB rocket: HWK

AAPL and BIDU had large volume intraday declines but closed well off their lows. Such “air pockets” could be a sign of weakness to come. However, their daily and weekly up-trends remain intact for now. Tuesday was the 16th day of the current QQQQ short term up-trend. During this up-trend the QQQQ has gone up 8%, while the QQQQ ultra long ETF (QLD) has risen 17%. In the same time period, HWK has risen 18%. HWK is an RWB stock I have been following for quite a while. It has been on my cumulative IBD100 list since August. I do not own it. (Click on weekly chart to enlarge.) RWB rocket patterns were explained in my Monday post.

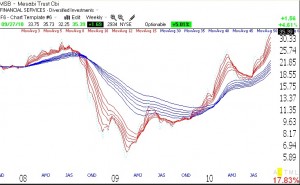

End of quarter window-dressing; RWB rocket: MSB

With the end of the third quarter upon us, I am holding on to stocks that have been strong. I expect that mutual funds are acquiring them so that they will look good when their reports of their holdings come out. Why the SEC does not require funds to report their average cost (purchase price) of their holdings is beyond me. So funds can buy the strongest stocks at the end of the quarter and customers will assume their fund managers were smart enough to have bought them in time to profit from their rise. I am likely to become more defensive next week as we go into the short period before earnings are released.

Below is MSB, another RWB rocket stock: