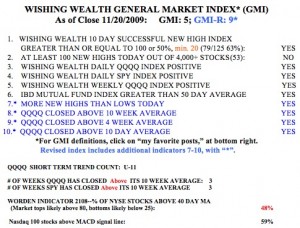

There are a number of stocks that came up in my “Darvas Scan” that are trading near five year highs and have good technicals and fundamentals. These stocks include: NEU, PCLN, AMZN, NFLX, EGO, LZ, CML, ABV, CBD, WCRX, EW, WES, CPLA. Some of these stocks may turn out to be rockets if the market up-trend continues. Meanwhile, the GMI

is at 5 (of 6) and the GMI-R is 9 (of 10).  While the long and short term trends are up, the daily stochastics (10,5,5) for the major averages are in down-trends, suggesting some weakness in the next few days. I will hold off on making any new long purchases until the stochastics turn up again.

While the long and short term trends are up, the daily stochastics (10,5,5) for the major averages are in down-trends, suggesting some weakness in the next few days. I will hold off on making any new long purchases until the stochastics turn up again.

Dr. Wish – what is the Darvas scan? Have you ever posted the elements that make up this scan? Tahnks, in advance.

Dr. Wish, Darvas’ strategy does not work all the time. All those I’ve bought this year at the highest price turned out to be losers because they came down fast and never went back up all the way, short or long term. In 2009 I’ve profited only buying those near the bottom price. A short while ago, you said yourself you lost money buying at peak price. Perhaps Darvas’ plan worked during his time, not during our current economy. Agree?

The Darvas approach of buying strong stocks near all-time highs still works. A key to his success was placing close stop losses below his break-out point so that when he was wrong he lost little. It took me a long time to realize the key to profits was to have many small losses and a few large gains. All winning strategies suffer losses. The key is to follow one’s rules, taking small losses, until one hits a winner. NEU is an example of a stock near its all-time high that broke out from a base to a new high on 8/24/2009, around 83.50. It closed on Tuesday around 110. I have found it useful to look at charts of past winners and to look for successful buy points that I could apply to other stocks.

A common mistake is buying overextended out of a base. Better to buy coming out of a low volume cup after the last remaining sellers have been shaken out. Without those sellers, the stock can now rise.